Case Summary:

Mattel

NASDAQ

MAT

Date Filed

06/27/2017

Lead Plaintiff Deadline

08/28/2017

Class Period

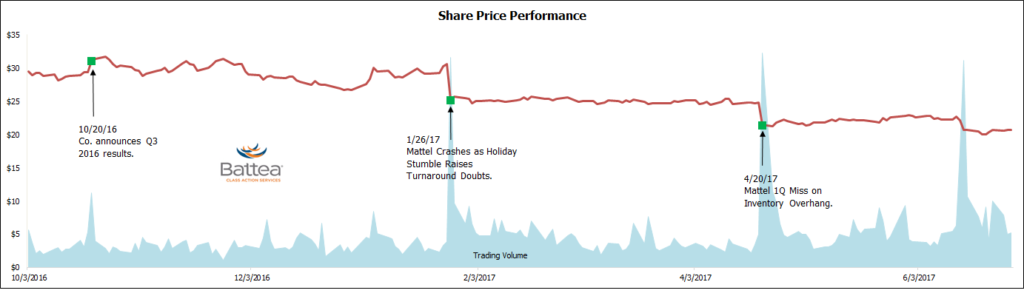

10/20/16 - 4/20/17

This is an abbreviated version of Battea’s Mattel securities litigation proprietary research. Full case summaries and economic analyses are available to clients through Battea’s litigation monitoring portal. For more information, or to request a demonstration, contact Battea.

Case Summary

Securities class action lawsuit on behalf of purchasers of Mattel publicly traded securities between October 20, 2016 and April 20, 2017, pursuant to sections 10(b) & 20(a) of the Securities Exchange Act of 1934. To read more about the Mattel securities litigation, visit Battea’s Mattel news article.

Preliminary Allegations

The complaint alleges that defendants failed to disclose the following adverse facts: (i) prior to and during the class period, Mattel’s retail customers were loaded with extremely high levels of unsold product; (ii) as a result of Mattel’s high levels of unsold inventory at its retailers, the Company was exposed to the heightened risk that it would have to issue its retailers financial concessions in the form of sales adjustments and discounts, to remove the excess inventory; (iii) the representations in Mattel’s Q3 Form 10-Q about its risk factors and disclosure controls were materially false and misleading; and (iv) as a result, defendants lacked a reasonable basis for their positive statements about Mattel’s then current business and future financial projections.

Brief Company Profile

Mattel, Inc. designs, manufactures, and markets a range of toy products worldwide. The company operates in three segments: North America, International, and American Girl. Mattel, Inc. was founded in 1945 and is headquartered in El Segundo, California.

Court: C.D. California

Docket: 17-cv-04732

Judge: Virginia A. Phillips, presiding

Plaintiff(s): WATERFORD TOWNSHIP POLICE & FIRE RETIREMENT SYSTEM

Defendant(s): MATTEL, INC., CHRISTOPHER A. SINCLAIR, RICHARD L. DICKSON, KEVIN M. FARR and JOSEPH B. JOHNSON