Overview

CASE SUMMARY

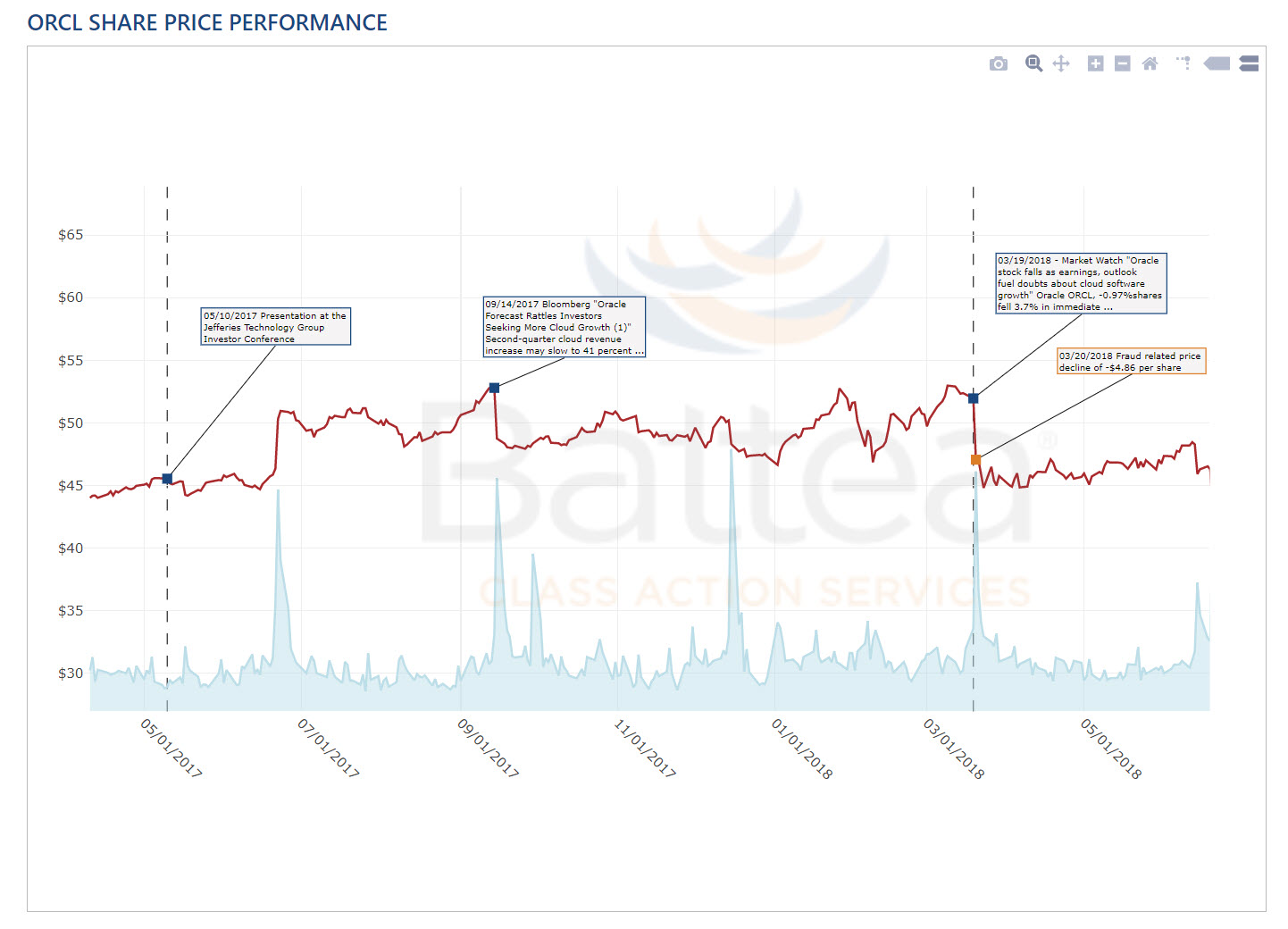

Class action on behalf of purchasers of Oracle stock between May 10, 2017 and March 19, 2018, pursuant to Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

PRELIMINARY ALLEGATIONS

The complaint alleges that defendants' growth in its Cloud revenues were driven, in part, by improper, coercive sales practices, which include: (1) threatening existing customers with audits of their use of Oracle's non-cloud software licenses and levying expensive penalties against those customers, unless the customers agreed to shift their business to Oracle cloud programs; (2) decreasing customer support for certain Oracle on-premises or hardware systems, in an effort to drive customers away from such systems and into cloud-based systems; and (3) strong-arming customers by threatening to dramatically raise the cost of legacy database licenses if the customers choose another cloud provider.

| Lead Plaintiff Deadline: | October 09, 2018 |

| Status: | Pending |

| Preliminarily Approved Settlement Fund: | TBD |

| Class Period: | May 10, 2017 - March 19, 2018 |

Class Period Events:

May 10, 2017

Presentation at the Jefferies Technology Group Investor Conference

September 14, 2017 - Bloomberg

"Oracle Forecast Rattles Investors Seeking More Cloud Growth (1)"

- Second-quarter cloud revenue increase may slow to 41%

- Shares drop as outlook overshadows upbeat first-quarter report

March 19, 2018 - Market Watch

"Oracle stock falls as earnings, outlook fuel doubts about cloud software growth"

Oracle ORCL, -0.97% shares fell 3.7% in immediate after-hours trading following release of the report, a gap that expanded to more than 6% after Oracle co-CEO Safra Catz provided the fourth-quarter forecast in a conference call. That forecast was short of expectations in total cloud sales, after the third-quarter numbers came up slightly short in cloud-software growth, fueling fears that Oracles cloud transition is slowing down.