Overview

CASE SUMMARY

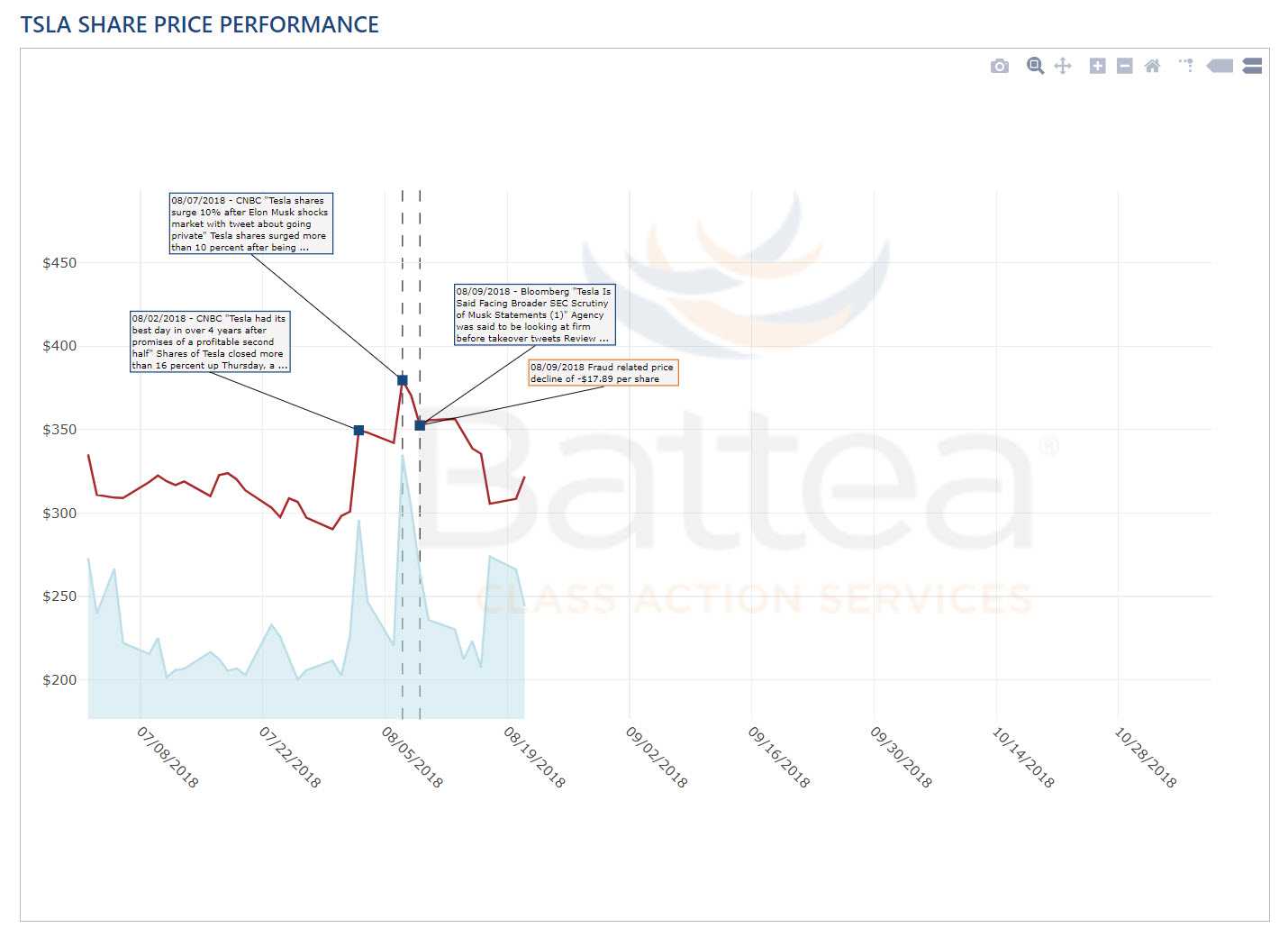

Class action on behalf of all persons and entities, other than Defendants and their affiliates, who purchased or otherwise acquired Tesla common stock from August 7, 2018 through August 9, 2018, pursuant to sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

PRELIMINARY ALLEGATIONS

The complaint alleges that the defendants (i) deceived the investing public regarding Tesla's business, operations, management, and the intrinsic value of its common stock; and (ii) caused Plaintiff and other shareholders to purchase the Company's common stock at artificially inflated prices.

| Lead Plaintiff Deadline: | October 12, 2018 |

| Status: | Pending |

| Preliminarily Approved Settlement Fund: | TBD |

| Class Period: | August 7, 2018 - August 9, 2018 |

Class Period Events:

August 2, 2018 - CNBC

"Tesla had its best day in over 4 years after promises of a profitable second half"

Shares of Tesla closed more than 16 percent up Thursday, a day after CEO Elon Musk and the automaker promised a profitable second half of 2018 during its second-quarter earnings report.

August 7, 2018 - CNBC

"Tesla shares surge 10% after Elon Musk shocks market with tweet about going private"

Tesla shares surged more than 10 percent after being halted for more than an hour. Musk issued a string of tweets about possibly taking the company private at $420 a share. Later, the company issued a blog post that said a final decision had not yet been made. Tesla's market value at $420 a share would be about $71 billion.

August 9, 2018 - Bloomberg

"Tesla Is Said Facing Broader SEC Scrutiny of Musk Statements (1)"

Agency was said to be looking at firm before takeover tweets. Review adds to pressure on Musk over company statements.

(Bloomberg) -- The U.S. Securities and Exchange Commission is intensifying its scrutiny of Tesla Inc.s public statements in the wake of Elon Musks provocative tweet Tuesday about taking the electric-car company private, according to two people familiar with the matter.

SEC enforcement attorneys in the San Francisco office were already gathering general information about Teslas public pronouncements on manufacturing goals and sales targets, according to the people who asked not to be named because the review is private.

Now, attorneys from that office are also examining whether Musks tweet about having funding secured to buy out the company was meant to be factual, according to one of the people.